Came across the use of Opprobrium in context of the shaming the conduct of Valeant Pharmaceuticals, once the darling of Wall Street

It stands for Harsh Criticism or Censure or public disgrace for shameful conduct…. Valeant has been accused of Price gouging, secret network of speciality pharmacies & fraud

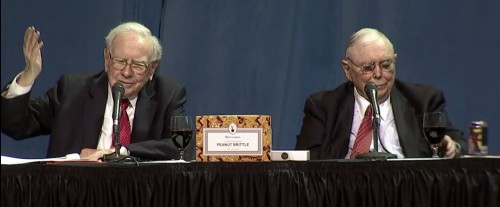

Always loved the Bluntness of Charlie Munger ,Vice Chairman of Berkshire Hathaway.He’s 92 now and his words carry huge weight

Yesterday at BH’s AGM in Omaha,both Warren Buffett & he took on pre-selected questions for several hours.This Q & A is one of the most awaited sessions at the AGM

A question was asked on Sequoia’s Investment in the embattled Valeant Pharmaceuticals.Warren likes Sequoia but their decision to invest in Valeant was unfortunate & the manager who made that decision has been fired

Here’s what both Buffett & Munger said on Valeant yesterday

Charlie Munger ~ “Valeant of course was a Sewer and those who are directors deserve all the OPPROBRIUM they’re getting”

Warren Buffett ~ “In my view the Business Model of Valeant was enormously flawed…….one can see patterns of ‘Chain Letter’ Wall Street Schemes….If you’re looking for a manager you want someone who is intelligent, energetic, and moral.But if they don’t have the last one, you don’t want them to have the first two”

In 2015 William Ackman whose Pershing Square Fund has been much maligned for supporting Valeant and taking a huge equity position of @ 9% equity stake in it had sought Warren Buffett’s help in seeking an appointment with Charlie Munger with the then CEO of Valeant,Michael Pearson.Buffett directed Ackman to connect directly with Munger. Munger did not respond…..Pearson is just out and Valeant has a new CEO Joe Pappa

Valeant Pharma’s Share Price is just under US $ 34 today with a fallen market cap of US $ 11.45 b.It’s crashed from a 52 Week High of US $ 263.81 ! but up from a 52 week low of @ US $ 25

This has always been my pet theme of debate with many who grudgingly respect my principles but in the same breath think I’m foolish to let go a brilliant investment opportunity !

“Should you always shun a Company which has demonstrated serious lapses on Corporate Governance even if the Share Price & Objective Valuation beckon to buy?”

“Is Value always determined in Numbers?”

Each to his Own,I say !

Warren Buffett is 85 & Charlie Munger is 92 !~I’ll be 54 in August this year ~ What’s that you say !? ~Age is just a Number

What I can say is this ~ Bill Ackman certainly is Valiant in defending Valeant ! even if it’s cost his Pershing Funds & Clients Billions of Dollars in notional loss ~ What a conviction to hold on to! ~ Foolish to most !

And then even some of Warren Buffett’s Investments have raised ethical questions :

~ his pet bank Wells Fargo for instance just agreed to settle a US $ 1.2 b mortgage settlement after initially denying any wrongdoing

~ his love & defense for Coca-Cola is well known though it’s widely perceived now as an unhealthy heavily sugared carbonated beverage.Yet Buffett credits his five 12 oz cans a day of Coke =>700 cals to his good health & happiness…says if he switched to water & broccoli he would not have been healthier ! ~ my view is that Coke can be addictive…believe me,I was hooked onto it and felt great & could consume a litre at a time !…gave it up as it definitely is a health hazard…Buffett must then admit he’s lucky that Coke’s not affected him like it has millions ~ but amusingly he does not believe Luck has anything to do with Success in his Investments,Coke included ! ~ Let’s just say he’s been Lucky with Coke~ Consumption & Investment both!~whether he admits it or not

Any such situation in the Indian Context !? ~ Many ~ One such is Diamond Power that I blogged on extensively just a few weeks ago ~ it’s flared on three consecutive upper circuits to cross Rs 45…was @ Rs 600 levels in 2007/8 & @ Rs 150 levels just a year and a half ago

Kotak Group Again Enters Beleaguered Diamond Power Infra At Rs 23.65 ~ Why?

April 7th, 2016

😆 So is Kotak for Diamond what Bill Ackman is for Valeant !?

& What about FPI Darling Treehouse Education that was uprooted inside a year by 80+% from levels of Rs 500+ to currently Rs 80!? ~ blogged extensively on this in November 2015 too…check out the link below

Tree House Education up Shit Creek & Down Market Big Time at Rs 169

Friday, November 27th, 2015

Cheers !