Interesting Choices for a 10 year Investment ~ US Treasury Notes in US $ or State Bank of India Fixed Deposit in Indian Rupees ?

What would you choose ? 😕 ~ An Indian Resident is now allowed Overseas Investments up to US $ 200000 annually

US Treasury Note 10 Year Yield is currently 1.66%

SBI 10 Year FD Yield is 14.35 % (Interest Rate is 9 % compounded annually)

Let’s stick to the basics ~ whenever assessing Investments use the SLR Criteria ~ Safety,Liquidity and Returns

Safety ~ Both Investments are relatively Safe ~ SBI FD more so maybe ! 🙂

Liquidity ~ Both are fairly Liquid and can be liquidated before Maturity

Returns ~ Ah! herein lies the Million Dollar Question ! ~ The Treasury Note (see below) offered fixed 1.75% Interest pa,payable half yearly.The SBI FD offers 9% pa compounded annually

On the Face of it the Yield of the SBI FD is Much Higher as there is a CAGR of Interest too ~ However we need to look beyond

A 10 Year US $ Treasury Note issued in May 2012 had the following attributes when auctioned

| Security | Type | Issue Date |

Maturity Date |

Interest Rate % |

Yield % |

Price Per $100 |

||

|---|---|---|---|---|---|---|---|---|

| 10-YEAR | NOTE | May 15,2012 | May 15,2022 | 1.750 | 1.855 | 99.045657 |

For a 10 Year Treasury Note the Interest is paid every six months,so there is no CAGR of Interest as in the case of the SBI FD.This Interest is not subject to local and state income taxes but is subject to federal income taxes in USA.On Maturity Date the Face Value is paid ,that is US $ 100 ~ am not considering reinvestment of Interest received ~ if I do so the Returns on the Note from the Original Principal will be higher

Treasury Note Yields are not expected to rise significantly till 2014 atleast as USA attempts to revive it’s Economy through Quantitative Easing Measures and providing stimulus for more Investments and Production and Consumption without flaming Inflation and in an effort to tackle Unemployment that threatens to break 10% all the time

What we need to understand is the Exchange Risk ~ as one Investment is in US $ and the Other is in Indian Rupees ~ The Returns have to adjusted for the exchange movements from the date of Investment to the date of Maturity

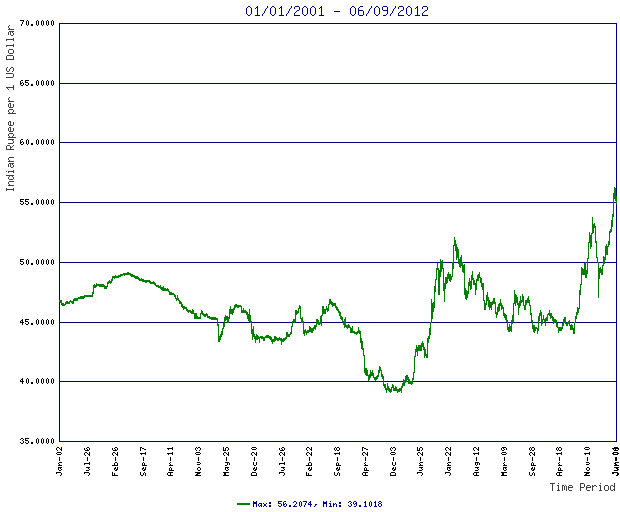

The Rupee has seen a declining trend for decades.However In the 21st century from 2001 to date June 9,2012,nearly 11 and a half years it has been reasonably more stable than in the previous decade (decline was @ 40% in 1991-2001) and has declined @ 22% as below (www.exchangerate.com) from levels of Rs 46=US $ to Rs 56 US $

Assuming in the next Ten Years by 2022 the Indian Rupee declines @ 20 % to reach Rs 67 =US $ then the Returns to the Indian Investor who has taken a Treasury Note Exposure will be in excess of 21%

Here the Spread between the SBI FD Yeild and US Treasury Note Yield is 12.69% (14.35- 1.66)…This implies that at the end of 10 years if the Rupee is @ Rs 63 = US $ then both Investments would have yielded the same

To put it another way ~ If you believe the Indian Rupee will not decline as much as 20% against the US $ in the next 10 years and will do so not more than 12.50% and even in fact may even appreciate as you believe the US $ will weaken ,then clearly the SBI FD will give you a better Return

Net Returns will need to be assessed considering Application of Taxes , Movement of Exchange Rates and the Compounding Effect on Interest

To me the major criteria to assess the Returns is the Movement of the Indian Rupee against the US $ in the coming decade ~ Stable,declining or appreciating ? and the intensities…..

The World’s Reserve Currency is the US $ and Oil Trade is largely in Petro Dollars and this is keeping the US $ alive in a sense apart from the capital flight to US $ Treasury Notes and Bonds because of the Euro Crisis and the absence of widespread access to the Chinese Yuan and the already relatively high Price of Gold ~ The Chinese Yuan is the strengthening Currency and is widely believed will one day take over from the US $ as the World’s Reserve Currency ~ Indications are already there as leading International Banks are opening up Yuan Deposit A/cs and International Trade too is being conducted without any US $ underlying

India remains an Oil Intense Nation ~ Currently 83% of it’s Oil & Gas Requirement is imported ~ that’s over 170 Million tonnes ~ FY 12 saw an Oil & Gas Import Bill of US $ 155 Billion ~ causing a record 4% Current A/c Deficit

Moreover there is a growing geo political alliance between India and USA,the two largest Democracies on Planet Earth ~ to thwart China’s Intentions and moves ~ Huge Nuclear for Civil Purposes Deals are being signed with USA

India’s Dependence on USA in many ways cannot be understated ~ and along with Dependence on Oil Imports,this may just keep the Pressure on the Rupee even if our GDP Growth climbs back to 7% to 9% levels

My Heart angrily Insists that our Rupee must Appreciate against the US $ ~ My Head tells me that we continue to be weighed down by the US !

So what should it be for a 10 Year Debt Investment !? US Treasury Notes or a State Bank of India Fixed Deposit !?

To me it’s not as Clear Cut a Choice…how about to you ?

Food for Thought for this Weekend and Beyond !

4 thoughts on “Interesting Choices for a 10 year Debt Investment ~ US Treasury Notes or State Bank of India Fixed Deposit ?”

If in unclear state of mind invest in both and see where the return is better.

I know this is purely a comparison of ‘debt instruments’ but was just pondering what if we add Gold to this equation? Given that the world is in turmoil & the increasing demand for Gold from India & China along with the huge amounts being pumped in via investmnets(ETF’s, gold schemes, etc) & ASSUMING Rupee depreciates & further ASSUMING Gold appreciates more than its historical CAGR of 4-5% due to safe haven investment. I’m gonna put my money where my mouth is and invest in Gold ETF’s , the cheapest way to invest in Gold in India! 😀

Yes Swaroop,Who does not love Gold !…this blog post was for safe and sure fixed return instruments in different currencies ~ Gold is another Asset Class and Returns from it like Equity cannot be guaranteed…Cheers

Gaurav,

Why do you say “My Head tells me that we continue to be weighed down by the US !”

Unless GOI brings down account deficits, inflation will be high, so the interest rates and rupee continues to fall wrt dollar.

I will continue to invest in companies with book value close to 1 price/book and shun gold.

Oil is essential but gold is not (unproductive). Gold is a drain on our foreign exchange and a huge contributor to our current account deficit.

Shunning gold is a patriotic thing to do! Discourage gold buying.