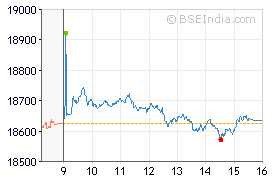

Markets Correcting Sharply as we end the week ! ~ Sense some Panic among Brokers and Traders who are getting Frantic ~ Investors should not Worry ! ~ Had warned Brokers in the morning not to hold long intraday or trading positions for clients or themselves as the correction was indicated ~ Of course Investment in select scrips can continue to be made for the Long Term ~ they may not correct sharply though every correction can offer better entry levels

It’s past 3 pm and the Sensex is down over 150 points at 18316 and the Nifty is down near 60 points at 5572 ~ Next Week should see some more correction

Have a Great Post Diwali Weekend

Cheers !

P S : Sensex actually closed at 3.30 pm down over 200 points at 18269 but official adjusted closing is a little higher at 18309

It was an Intra Day Closing Correction that gathered momentum and was accentuated by strong unwinding of longs after 3 pm

3 thoughts on “Markets Correcting Sharply as we end the week ! ~ Sense some Panic among Brokers and Traders who are getting Frantic ~ Investors should not worry !”

Dear Gaurav,

Hope you are doing good.. My question to you is slightly out of context to your article, but do you have any different opinion offlate on Innovasynth Investments ? When it was listed at about Rs12 sometime back, you felt and wrote on your blog that it’s grossly underpriced. But now it’s trading at almost 1/3rd of that price.. What’s your take on this stock and company now ..? do you suggest a buy ..? Can the management be trusted to be investor friendly ?

Regards,

Nisheeth

Yes Nisheeth I’m perturbed by what’s happening in Innovasynth Investment s (ISI)~ It’s only reason for existence is the 32% it holds in the unlisted Innovassynth Technologies (IST) and therefore it derives it’s value from this underlying ~ I had blogged on this in September 2010 guestimating that the value of IST was much more because of Property and Investment Values not reflected properly in the Book,than the audited Networth of @ Rs 90 crs as at March 31,2010 and what the Promoters would have us believe and thus the ISI Pricing on Listing too should reflect this ~ ISI listed at Rs 12 and then has sunk over two years to under Rs 4 ~ So has IST just been a ordinary Operation for oncology research ~ ISI’s Annual Report FY 2012 carries a Management Analysis of IST ~shows 241 ( there were 261 in FY 10) Employees with 5 Doctorates (PhDs) and 60 Chemists and long term contract with BASF for a single product produced 372 t in Fy 12 and have received order for 384 t in FY 12-13 ! so I guess there is something sound taking shape! I have not been able to source the full latest Annual Report of IST as at March 31,2012 to assess the current position and value ~ At under Rs 4 ISI’s Mkt Cap is just below Rs 10 crs while the Book Value in 2010 of IST was Rs 12.13 with Net Worth at Rs 89.82 crs ~ FY 11 and FY 12 Turnover is Rs 49.34 crs and Rs 50.71 crs respectively with loss at Rs 10.29 crs and Rs 5.83 crs respectively ~ has affected Networth of IST to Rs 73.7 crs at March 31,2012 dropping the BV to below Rs 10 FV at Rs 9.96 thus giving a Book Value of ISI’s 2.38 crs shares holding in IST of just under Rs 24 crs ~ measure this against the ISI Market Cap of under Rs 10 crs ~ IST continues making losses and has yet to achieve break even cash and sales to support Investments made and the financial and depreciation costs ~but the Directors remain confident of a better turnover and more orders once clinical trials are successfully completed ~ It’s been eight years of research ~At Rs 3 to Rs 4 for a FV Rs 10 Stock , ISI should surprise you on the upside but need to study IST’s latest financials,assets and liabilities and operations for a firm opinion ~Corporate Governance has been quite poor and the arrogance,if I can call it so,of IST Shareholders,the Ghias and Rahejas and even Rakesh Jhunjhunwala to first create ISI route and keep entitled shareholders directly away from IST and not be forthcoming on IST Property Assets & Investment in Actis Values needs to be challenged~ this is probably the controversial reason the promoters and their group have directly invested in the IST Rights Issue at par applying for even the renounced rights of ISI in IST Rights Issue which they being Common Directors on both Boards let go….Methinks the next three years will give a strong breakout in IST and thus ISI Share Price too should move up from Rs 3 to Rs 4 currently

Thanks Gaurav for your insight on IST and ISI. Stock looks cheap to me too but the quality of management makes me a bit wary. Appreciate your view again if situation changes or new facts are known on this counter. Albeit today is quite an unusual volume and seems to me change of hands in bulk deal… Anyways thanks again !