Happy New Year to all of you

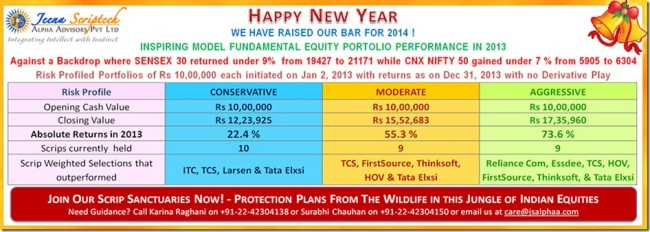

Have raised the Bar for 2014 in my Company with an Inspiring Model Fundamental Equity Portfolio Performance in 2013 without resorting to any Derivative Play too !

Have a Look !

The Returns in 2013 have been 22%,55% & 74 % for the Three Risk Profiled Portfolios ! while the Sensex & Nifty have returned under 9% and 7% respectively

There has not been much churning too during 2013 ~ Transactions also involved Averaging Purchases and Partial Sales in specific Scrips

Number of Transactions in 2013 were as below :

Conservative Portfolio : 16 Purchases and 5 Sales

Moderate Portfolio : 22 Purchases and 13 Sales

Aggressive Portfolio : 22 Purchases and 12 Sales

BSE & NSE Brokers may not like this less churning and no derivative play too much as their business survives on Brokerage Income ~ and more the churning and more the F & O Play more will be their Brokerage ! regardless of whether their Client makes money or not ! ~ Clients tell us how often they are bombarded with Buy and Sell calls from their Brokers ! ~ our advice to them has always been to use the Broker and not let him use you !

Having said this,if your mindset, strategy and approach is to churn and trade and speculate often and you are able to generate good to great returns then don’t grudge the Broker their Income from your transactions ! ~ you’ve made your Money ~ let them make theirs ! ~ what you do need to watch out for is that you are not overly influenced to trade and speculate often by friends, advisors , brokers and experts on the stock channels ~ Protect your Interests first ~ it’s your Money at stake !

It’s going to be a huge challenge to sustain such a portfolio performance in 2014 despite the year looking bullish

Scrip Selections were from our SS Series 1 to 4 that featured in the Scrip Select,Scrip Scramble and Scrip Springboard Modules

However a few Trading Calls were made in the Moderate and Aggressive Portfolios on some Scrips like Reliance Com & Essdee Aluminium that were featured in the Network Noise Module

What was really disappointing was L& T Finance dropped from Rs 90 + levels at the beginning of 2013 to close the year at Rs 75

Also Zandu Realty did not live up to it’s potential and I suspect it dropped sharply because of corporate governance issues

While Multibagger Westlife Dev (MacDonald Operations in West & South India) outperformed it was hard to get into as it was on upper circuit for months

Other Multibaggers underperformed but constituted under 5% of the Portfolio

Cheers !

3 thoughts on “Raising the Bar with An Inspiring Model Equity Portfolio Performance in 2013”

Hi Sir,

My second choice is Oil India, the price is at par to the valuation of last year it has potential to go to Rs 550/- in 2014.

Curious why you added Firstsource into your portfolio.

Hi Srinivas, if you search my blog using the search feature you will find I have been tracking Firstsource from way back on January 30, 2009,repeated it on Feb 5,2009 and again on May 20,2009….traded on it at Rs 9 + exiting at Rs 15 to Rs 21 range in the same year 2009 though it shot to Rs 40 in November that year….My Company gave it as as a SS 1 Select on October 26,2012 at Rs 12.65 and we averaged when it fell to Rs 10 in 2013….The Big Guy Rakesh Jhunjuhunwala entered it picking up a 4% stake in July 2013 at @ Rs 12/13/14….to answer your question we made the selection because it changed hands and has been now able to manage it’s FCCB Debt much better and makes the instalments on time…the Rupee depreciation was hurting it bad….it remains a fairly good operating business