US Stocks Beginning to Bubble ?

Would seem so if one goes by the Market Cap/GDP Indicator of 1.4… US Market Cap is @ US 23 Trillion with the US GDP in 2013 @ US $ 16.9 Trillion …these are data points direct from the source

US Stocks Crash is expected in 2014 by quite a few …..“We have no right to be surprised by a severe and imminent stock market crash,” explains Mark Spitznagel, a hedge fund manager who is notorious for his hugely profitable billion-dollar bet on the 2008 crisis. “In fact, we must absolutely expect it.”

“We are in a gigantic financial asset bubble,” warns Swiss adviser and fund manager Marc Faber. “It could burst any day.”

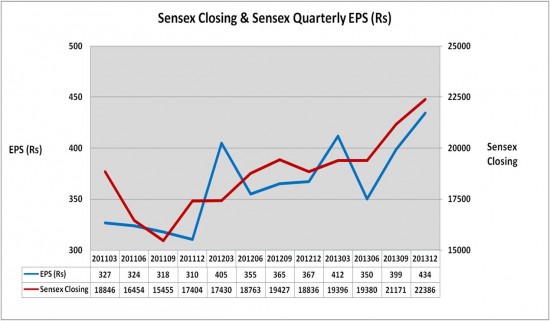

This Divergent Graph below lends support to the fact that Earnings have not Driven the Index like they should …The Index has had a Upward Momentum of it’s own despite Drop in Earnings

The Indian Situation is actually different as the Sensex vs EPS Graph below depicts…so should we be really worrying too much looking at US Potential Crash Scenario being replicated here !?

Clearly the Next Trigger for our Sensex is the outcome of the ongoing General Elections…we will know by Mid May if Narendra Modi will be our PM and BJP will come back to power on it’s own or leading a NDA Coalition government

Then Sensex swiftly towards 25000 from current 22500 levels ?

Will the US Scenario not Matter ?

What about strong FII Inflows of US $ 4.5 Billion in 2014 so far propping up our Sensex ? Will this Liquidity continue even if Interest Rates begin rising in the USA later in 2014 as QE eases out ?

US Markets are trading at 15.5 Forward PE….. that’s higher against 13.2 and 13.8 5 year and 10 year averages respectively

Indian Markets too are trading at Forward of 15+ with FY 15 Sensex EPS Projected at Levels of Rs 1500 and current Sensex at 22500 levels…This is not overvalued by any stretch of Imagination…In fact on the contrary with a dismal GDP Growth of under 5% behind us there is an Earnings Optimism now developing

India’s Market Cap to GDP is 0.67 with Market Cap at Rs 7471165 crs or US $ 1.25 Trillion day before and GDP FY 14 expected to be Rs 11200000 crs or US $ 1.87 Trillion with US $ =Rs 60

🙂 Sensex 27000 Anyone later this year ?

3 thoughts on “US Stocks Beginning to Bubble ? Should India Worry ?”

Great timing Gaurav.

Today people will laugh if someone says Dow is ready to decline 20-21% in next few weeks . Nifty has strong correlation with Dow since Jan 2013 so I wouldn’t be surprised if Nifty also goes down with similar percentage. NDA may NOT get clear majority and I guess that could be time?

Many ‘Ifs’ Jigs 🙂 though some say it’s not a question of ‘If’ but a question of ‘When’…in a bullish frenzy,Valuation plays a backseat to Liquidity,Sentiment and Momentum…just as it will in a bearish frenzy…that’s the time to be really buying deep…we have not seen a frenzy yet either way although the bullishness is very strong and is offering huge trading opps…A year or a little more ago we had done an extensive study between the corelation of Nifty,Sensex vs the Dow and the results were quite startling…the corelation is not as direct as the perception that it was…this blogpost too in a way shows this…we need not worry too much even if US Stocks tank

I could be 100% wrong but I doubt if de-coupling can happen for long. Statistically run 44 Rank Correlation Coefficient on weekly chart on Dow and Nifty. Since Sep 2013 you will see its 0.82 now which I think is strong positive correlation. If you see Dow going down it will be very diff for Nifty to remain flat/up. You could be right though abut when :-).