Hey Guys…..want my insights on our Sensex and Stocks and Risks and Returns in Indian Equity…we can deliberate and debate on these…..you can actually own me for a full two days for just under Rs 10000,inclusive of taxes !…….. as later this month I’m holding an exclusive and intensive and fun Two Full Days Workshop on

‘Equity Portfolio Structuring and Stock Analysis…Integrating Intellect with Instinct’

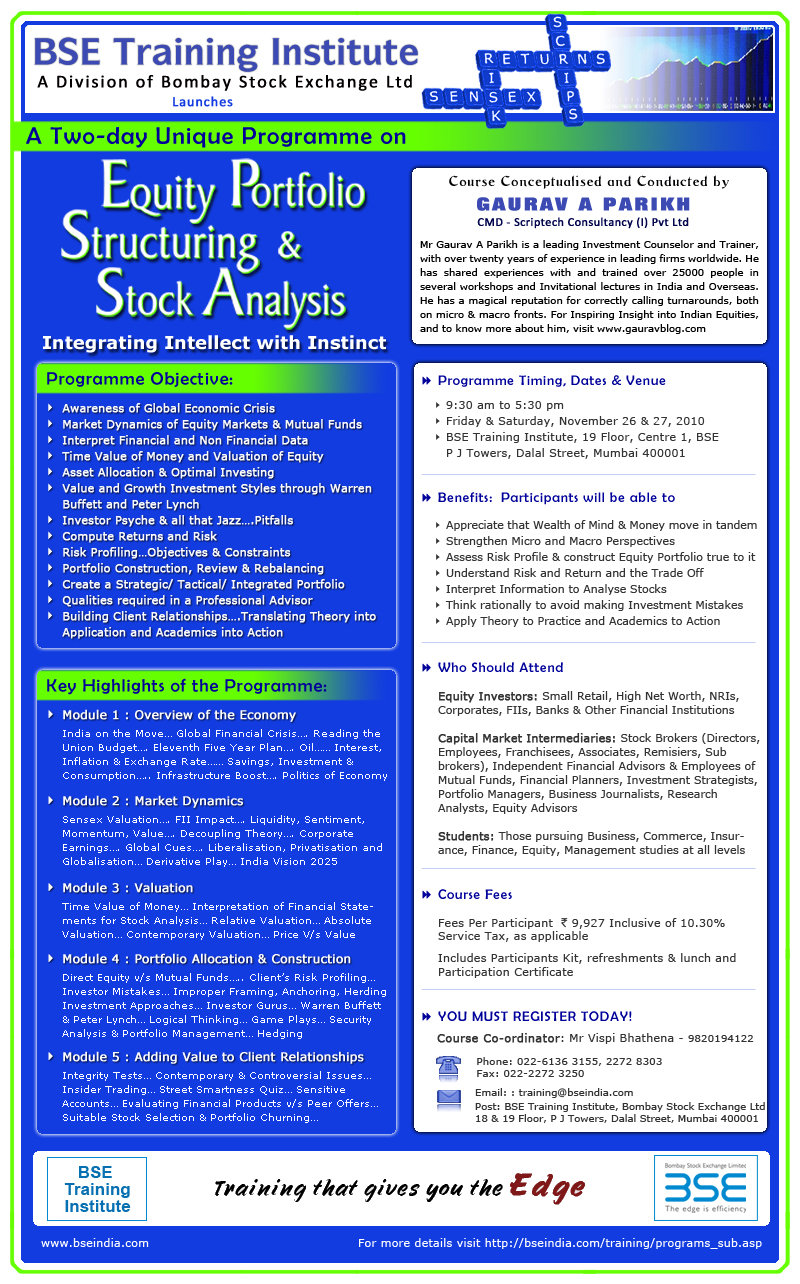

It’s on Friday and Saturday this month on November 26 and November 27 at the Bombay Stock Exchange Training Institute

…..should be a good investment !….so come for it….even if you have to travel to Mumbai for it !……just call BSE Coordinator ,Vispi Bhatena at the BSE Training on +91-22-61363155 or +91-22-22728303 to register and confirm a seat right away

….have already glimpsed at some of the confirmations….one Mutual Fund Group is sending quite a few…interesting

….it may be of some interest to you to know the profile of participants at my past workshops……I’ve had extremes in age….aggressive and enthusiastic 15 year olds to 80 year olds attending….youngsters are in a hurry….their fathers put up initial funds and look to gains from Equity to fund their overseas education …… gender numbers compete with each other…the females are smarter !….heads of research come for ideas and intellectual think trends…though I must confess most come for stock ideas !…that’s the most attentive and even the most boisterous time too !…largely covered during Valuation and Equity Portfolio Construction sessions but inevitable peppered right through both days…some want to learn to earn to burn !…many already hold equity worth lakhs and crores and are keen to protect and grow wealth…..I simply love interacting with all….the more you interact with me the more you shall get out of me !….I find that quite often I’m inspired by the participants…one was even a direct disciple of Sri Sri Ravi Shankar from the ‘Art of Living’….very adventurous too !….his focus was how and when to leverage through Derivatives !

….I shall show you how much risk you can assume and how to manage it so you can with some degree of conviction and confidence capture some opportunities for great potential multibaggers too which otherwise most experts will tell you to avoid as the risk is too high !

….also why you don’t need to indulge in Insider trading to grow your Equity Wealth…sensitive and highly arguable issue

…we shall also exercise our brains for logical and rational thinking…i shall give you situations to think out ……you will be surprised at the outcome….. why we yet behave irrationally ! at times

…..I have simply used logic to convert even cynics to Equity…the proof of the pudding,of course lying in the eating !

….my satisfaction would be to see all of you feeling relaxed,refreshed and rejuvenated after my sessions… just like you do when you come out of a good Health Spa …..inspired to go out there in Equities with conviction and confidence and tranform Academics to Action and Theory to Application

…the template below details what I’m going to cover and interact with the participants on

…if you feel you’re going blind trying to read the print in the template there is another option for you…..you can vist the BSE website for content details and even register online on the bse website at

http://www.bseindia.com/training/eq_portfolio.asp

or even scroll below the template for the BSE Emailer send for this course

Hope to see you’ll there !….Cheers !

BSE Training Institute has send out this emailer for this course….it covers the template above and profiles me a bit more in detail

Programme Objective:

§ Awareness of the Global Economic Crisis

§ Comprehend Market Dynamics of Equity Markets and Mutual Funds that influence Investments

§ Interpret Financial and Non Financial Data to analyze and value stocks

§ Get a basic yet firm understanding of the concept of Time Value of Money and it’s Application in Valuation of Equity and the various traditional and contemporary techniques applied in the Valuation Process

§ Understand Asset Allocation & Optimal Investing

§ Briefly examine Value and Growth Investment Styles through Warren Buffett and Peter Lynch

§ Investor Psyche and Pitfalls

§ Compute Returns and Risk

§ Risk Profiling…Objectives & Constraints

§ Portfolio Construction, Review and Rebalancing

§ Create a Strategic or Tactical or Integrated Portfolio on basis of Investor Risk Profile

§ Qualities required in a Professional Advisor

§ Building Client Relationships….Translating Theory into Application and Academics into Action

§ Portfolio, Pedigree, Psyche and PerspectiveKey Highlights of the Programme:

Programme consists of Five Fundamental Modules

Module 1: Overview of the Economy

India on the Move… Global Financial Crisis….Reading the Union Budget…. Eleventh Five Year Plan…. Oil…… Interest, Inflation and Exchange Rate……Savings, Investment & Consumption…..Infrastructure Boost…. Politics of EconomyModule 2: Market Dynamics

Sensex Valuation…. FII Impact…. Liquidity, Sentiment, Momentum, Value…. Decoupling Theory…. Corporate Earnings…. Global Cues…. Liberalization, Privatization and Globalization…Leveraging the India Story…..Derivative Play…India Vision 2025Module 3: Valuation

Time Value of Money… Interpretation of Financial Statements for Stock Analysis… Relative Valuation… Absolute Valuation… Contemporary Valuation… Price V/s ValueModule 4: Portfolio Allocation & Construction

Direct Equity v/s Mutual Funds: Interesting Angles….. Client’s Risk Profiling… Investor Mistakes… Improper Framing, Anchoring, Herding etc… Investment Approaches… Investor Gurus… Warren Buffett & Peter Lynch… Logical Thinking… Game Plays… Return & Risk…Portfolio Allocation… Portfolio Construction… Portfolio Measurement… HedgingModule 5: Adding Value to Client Relationships

Integrity Tests… Awareness of Contemporary & Controversial Issues… Insider Trading… Street Smartness Quiz… Managing Sensitive Accounts… Evaluating Financial Products v/s Peer Offers… Suitable Stock Selection & Portfolio Churning… Boosting & Balancing both Employer & Client InterestsBenefits of Attending the Programme:

Participants will be able to

§ Appreciate that Wealth of Mind and Wealth of Money must move in tandem

§ Strengthen Micro and Macro Perspectives to help form Investment Strategies

§ Assess their Risk Profile and Construct an Equity Portfolio true to it

§ Understand Risk and Return and the Trade Off

§ Interpret Financial & Other Information to subjectively and objectively Analyse & Value Stocks

§ Think rationally and logically to avoid making Investment Mistakes

§ Interact actively with Faculty and a wide spectrum of participants

§ Apply Theory to Practice and Academics to ActionWho Should Attend?

Equity Investors: Small Retail, High Net Worth, NRIs, Corporates, FIIs, Banks & Other Financial Institutions

Capital Market Intermediaries:

Stock Brokers (Directors, Employees, Franchisees, Associates, Remisiers, Sub brokers), Independent Financial Advisors & Employees of Mutual Funds, Financial Planners, Investment Strategists, Portfolio Managers, Business Journalists, Research Analysts, Equity Advisors and other financial intermediariesStudents: Those pursuing Business, Commerce, Insurance, Finance, Equity, Management studies at all levels

Course Fees: Fees Rs. 9000 Per Participant Plus 10.30 % Service Tax, as applicable.

Includes participant’s kit, refreshments & lunch and participation certificate.Course Coordinator: Mr. Vispi Rusi Bhathena, Manager, BSE Training Institute

Phone: 022 – 6136 3155, 2272 8303

Speaker Profile:Mr Gaurav A Parikh is a leading Investment Counselor and Trainer, heading Scriptech Consultancy (India) Pvt Ltd, with over twenty years of experience in leading firms in India and Overseas. He has shared experiences with and trained over 25000 people in several workshops and Invitational lectures in India and Overseas. He has addressed leading corporates and forums and conducted workshops for BSE, CRISIL, Dun & Bradstreet, ICICI Bank, Doha Securities Markets Corporation, Qatar Financial Markets Authority, AIMA,A P Chamber of Commerce, DTRTI, KPMG,SBI MF, SAFE, leading Broking Houses and many others on issues that influence the Indian equity markets & has a magical reputation for correctly calling turnarounds, both on micro and macro front. In early 2009 GAURAV A PARIKH saw some striking similarities to late 2001 when he had held a similar workshop on Repairing your Equity Portfolio at the World Trade Centre in Mumbai in 2001 and it’s versions at the BSE Training Institute. He had urged investors to be strongly contrarion and to reposition their equity portfolio…..rest is History as the Markets rebounded with great Vigour in the years that followed

He is a well respected and very popular faculty at the Bombay Stock Exchange Training Institute where he co- structured the very popular Fundamental Analysis Workshop and even co-authored the Text for it, which is a BSE Publication and also conceptualized and conducted the hugely popular One Day Intensive Equity Portfolio Structuring and Stock Analysis Workshop…he is a prolific blogger…check him out on www.gauravblog.com …. he has been voted Best Speaker at various forums and has received wide recognition and has been even felicitated by BSE on their Foundation Day and by the Mumbai University on completion of it’s 150 years.

2 thoughts on “You Must Come for my Two full days Equity Training Workshop at the Bombay Stock Exchange on Friday,November 26 and Saturday November 27,2010…should be a good investment and fun too!”

The bse site says Vispi Bhatena as the trainer

Hey Rajesh,

You have now got Vispi worried !….he is the Course Coordinator,not the Trainer….in charge of registrations etc….I checked the bse web site….perhaps you can provide the link where it mentions Vispi as Trainer and we shall have this rectified and remove his apprehensions….Cheers !